ET Online

ET OnlineNow make these changes in your Aadhaar Card online without visiting the Aadhaar Centre from November 2025

What NPCI circular said on PAN-Bank Account linking?

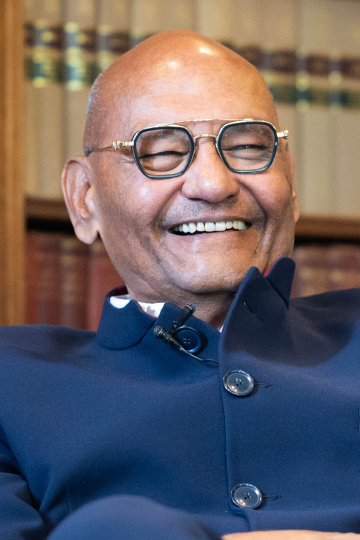

As a continuation of that initiative, NPCI has now introduced a new PAN and Bank Account Validation API designed specifically for Government departments. This API will facilitate real-time verification of PAN details, Bank account status and accountholder name directly from the bank's Core Banking System (CBS).Utkarsh Bhatnagar, Partner, Cyril Amarchand Mangaldas, says, “This will enable quicker and real time validation of PAN and bank account details of taxpayers accessing the Income Tax website.”

According to the NPCI circular on June 17, 2025, "This API will be used by Government departments to verify the customer account details like PAN validation/Account Status Validation/Account holder name validation from their bank CBS. As this is a service provided to the Government of India all the Member Banks are advised to take necessary steps for implementation on priority."

How will the new facility help in faster income tax refunds?

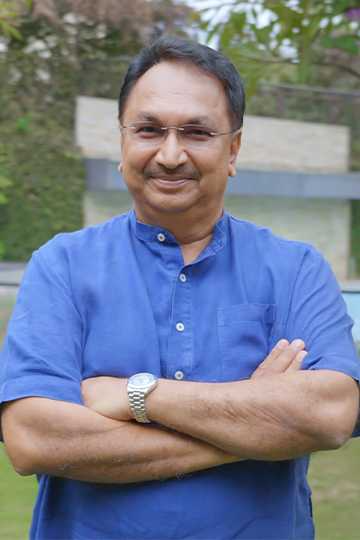

Bhatnagar says, “The new facility will enable faster and error-free processing of income tax refunds and direct benefit transfers by instantly verifying details, slashing delays and reducing fraud risks.”Banks will have to upgrade their systems to comply with NPCI’s secure API standards, which could involve significant operational changes. While taxpayers will benefit from faster, error-free refund processing, the transition may pose challenges like system upgrades and potential cybersecurity risks.

This initiative aligns with NPCI’s broader mission to strengthen India’s digital payment ecosystem, promising greater efficiency but requiring robust collaboration among stakeholders.